Understanding Chapter 12 Bankruptcy for Agricultural Producers

Ideally, agricultural business owners will be able to maintain a financially healthy business throughout their lifetime. However, in the event of extreme financial distress where financial obligations cannot be met, business owners may have to declare bankruptcy. Depending on your situation, there are several options available and benefits to these options.

Under the bankruptcy code of the United States, there are different bankruptcy chapters available, such as liquidation bankruptcy (Chapter 7) and reorganization bankruptcy (Chapter 11), among other bankruptcy filings. The Department of Justice and U.S. courts offer a special bankruptcy chapter to agricultural producers, called Chapter 12 bankruptcy. In this publication, we will look at the eligibility criteria for Chapter 12 and major characteristics of Chapter 12. The intent of the publication is to introduce some of the filing considerations and benefits of Chapter 12 relative to other bankruptcy chapters, not to give specific legal recommendations. If you are considering Chapter 12 bankruptcy, you should consult with a local bankruptcy attorney who is an expert in Chapter 12 cases.

Benefits of Chapter 12

Chapter 12 bankruptcy adjusts the debts of a family farmer. The farmer filing bankruptcy is called the “debtor.” Under Chapter 12, an individual farmer, couple, or sometimes a corporation or partnership can file a petition for relief. If relief is granted, debtors will receive a court order protecting them from their creditors.

One of the biggest benefits of Chapter 12 is that it allows the family farm business to stay open. When you file a petition under Chapter 12, it automatically stops most collection actions against the family farmer and the family farm. Thus, it allows the farm’s daily operations to continue. If the business is the family’s only means of income, the automatic stay is a vital lifeline. It can help the farmer navigate through a tough financial period.

Under Chapter 12, the farmer can reduce the obligation on secured debt to the value of the collateral. This feature is called “cramdown provision.” A cramdown allows the debtor to reduce the obligation on secured debt to the value of the collateral. For example, assume that a farm has a secured debt of $50,000 secured by collateral valued at $30,000. Because of cramdown, the debt value would be reduced to $30,000. The remaining $20,000 would become an unsecured debt and can be discharged in bankruptcy.

Other benefits include a more streamlined filing process for Chapter 12 relative to other reorganization filing procedures. Chapter 12 is a good option if the farmer is interested in continuing the farm operation. If this is not the goal of the farmer, then liquidation (no continuation of operation) filing may provide a faster process.

Eligibility Requirements of Chapter 12

Not all agricultural operations can file Chapter 12 bankruptcy due to several restrictions. To be eligible for Chapter 12, the following criteria must be met:

- The individual or individual and spouse must be engaged in a farming or commercial fishing operation.

- Total debts must not exceed $11,097,350 (if a family farmer) or $2,268,550 (if a family fisherman) if filing in 2023.

- If a family farmer, at least 50 percent, and, if a family fisherman, at least 80 percent of the total debts that are fixed in amount must arise out of a farming or commercial fishing operation.

- More than 50 percent of the gross income of the individual or the individual and spouse for the preceding tax year (or, for family farmers only, for each of the second and third prior tax years) must have come from the farming or commercial fishing operation.

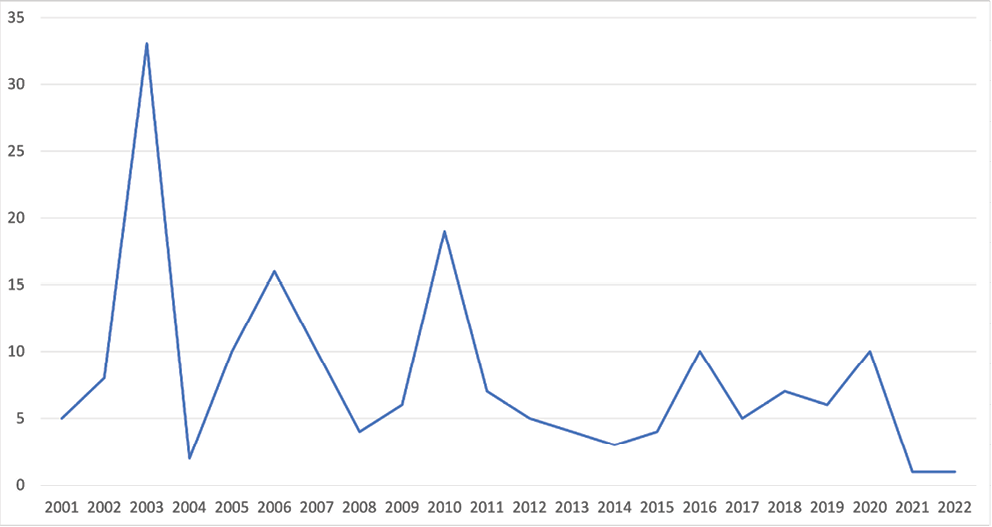

Number of Chapter 12 Filings in Mississippi

In Mississippi, Chapter 12 filings have been low and decreasing since 2001 (Figure 1). Since 2000, Chapter 12 filings have represented less than 0.5 percent of all bankruptcy filings in most years, suggesting possible underutilization of Chapter 12 in the state.

Source: U.S. Courts

|

Years |

Number of Chapter 12 Filings |

|

2001 |

5 |

|

2002 |

8 |

|

2003 |

33 |

|

2004 |

2 |

|

2005 |

10 |

|

2006 |

16 |

|

2007 |

10 |

|

2008 |

4 |

|

2009 |

6 |

|

2010 |

19 |

|

2011 |

7 |

|

2012 |

5 |

|

2013 |

4 |

|

2014 |

3 |

|

2015 |

4 |

|

2016 |

10 |

|

2017 |

5 |

|

2018 |

7 |

|

2019 |

6 |

|

2020 |

10 |

|

2021 |

1 |

|

2022 |

1 |

Overview of Chapter 12 Filing Process

Here, we provide a broad overview of the Chapter 12 filing process in Mississippi. Again, the purpose of the publication is to introduce some of the basics of Chapter 12 relative to other bankruptcy chapters, not to give specific legal recommendations.

To file Chapter 12 in Mississippi, a debtor must pay a $200 filing fee and a $78 administrative fee. The debtor must file a petition with the bankruptcy court serving the area where their business operates or they reside.

Usually, the debtor will have to compile the following information:

- a list of assets and liabilities

- a schedule of current income and expenditures

- a schedule of executory contracts and unexpired leases

- a statement of financial affairs to the court

- a list of all creditors, amounts, and nature of their claims

- the source, amount, and frequency of the debtor’s income

- a list of all the debtor’s properties

- a detailed list of the debtor’s monthly farming and living expenses

Items 5 through 8 are required in the official bankruptcy forms of petition. Once the petition is filed, an impartial trustee is appointed to administer the case. Filing the petition under Chapter 12 automatically stops most debt collection attempts by creditors.

Between 21 to 35 days after the petition is filed, the Chapter 12 trustee will hold a “meeting of creditors.” During the meeting, the trustee puts the debtor under oath, and both the trustee and creditors may ask questions. The debtor must attend the meeting and answer questions regarding the current financial affairs of their business and the proposed repayment plan. Normally, a debtor must file a repayment plan with the petition or within 90 days after filing the petition. The plan should provide information on the fixed payments to the trustee on a regular basis over the next 3 to 5 years.

The debtor will receive a discharge after completing all payments under the Chapter 12 plan. The court may grant a “hardship discharge”—discharge of debts without plan completion—to a debtor even though the debtor has failed to complete plan payments. Generally, a hardship discharge is available only to a debtor whose failure to complete plan payments is due to circumstances beyond the debtor’s control and through no fault of the debtor.

Again, it should be noted that a person interested in filing Chapter 12 bankruptcy should consult with a lawyer for any legal advice. To avoid financial distress and make a proper plan, please refer to other Mississippi State University Extension publications including the Farm Financial Analysis Series. Other useful sources on bankruptcy include:

The information given here is for educational purposes only. References to commercial products, trade names, or suppliers are made with the understanding that no endorsement is implied and that no discrimination against other products or suppliers is intended.

Publication 3956 (POD-11-23)

By Kevin N. Kim, PhD, Assistant Professor and Brian E. Mills, PhD, Assistant Professor, Agricultural Economics.

The Mississippi State University Extension Service is working to ensure all web content is accessible to all users. If you need assistance accessing any of our content, please email the webteam or call 662-325-2262.